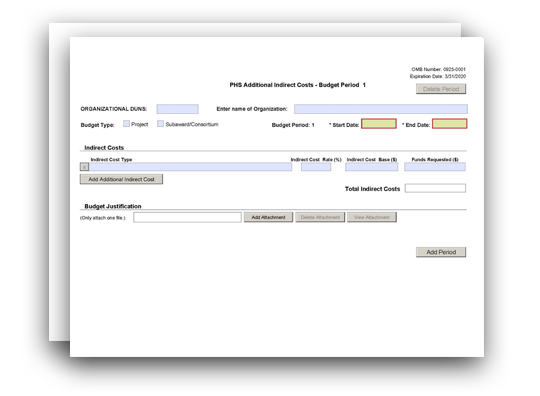

G.350 - PHS Additional Indirect Costs Form

The PHS Additional Indirect Costs Form is used only for multi-project applications. The applicant organization responsible for the Overall Component should use this form to detail its first $25,000 F&A costs on each subaward organization that leads a component.

Indirect Costs

Budget Justification

PHS Additional Indirect Cost - Cumulative Budget

Who should use the PHS Additional Indirect Costs Form:

The PHS Additional Indirect Costs Form is used only for multi-project applications.

The applicant organization responsible for the Overall Component should use this form to detail its first $25,000 indirect (Facilities and Administrative [F&A]) costs on each subaward organization that leads a component.

Introductory Fields

Unique Entity Identifier (UEI):

Unique Entity Identifier (UEI):

This field is required. Enter the UEI of the applicant organization.

Enter name of Organization:

This field may be pre-populated from the SF 424 (R&R) Form. Enter the name of the organization.

Budget Type:

This field is required. "Project" should be selected.

Budget Period:

This field is required.

Identify the specific budget period (for example, 1, 2, 3, 4, 5, 6, 7, 8, 9, 10).

Start Date:

This field is required and may be pre-populated from the SF 424 (R&R) Form. Enter the requested/proposed start date of the budget period.

End Date:

This field is required. Enter the requested/proposed end date of the budget period.

Indirect Costs

Indirect Cost Type:

Enter the type of indirect cost (e.g., Salary & Wages, Modified Total Direct Costs, etc.) and whether the cost is off-site. If more than one rate or base is involved for a given type of indirect cost, then list them as separate entries. If you do not have a current indirect (F&A) rate(s) approved by a federal agency, indicate "None—will negotiate" and include information for a proposed rate. Use the Budget Justification in this form if additional space is needed.

Indirect Cost Rate (%):

Enter the most recent indirect cost rate(s) established with the cognizant federal office, or in the case of for-profit organizations, the rate(s) established with the appropriate agency. If you have a cognizant/oversight agency and are selected for an award, you must submit your indirect rate proposal to the NIH awarding IC or to the PHS awarding office for approval. If you do not have a cognizant/oversight agency, contact the awarding agency.

This field should be entered using a rate such as "55.5."

Indirect Cost Base ($):

Enter the amount of the base for each indirect cost type.

Funds Requested ($):

Enter the funds requested for each indirect cost type.

See the NIH Grants Policy Statement, Section 7.4: Reimbursement of Facilities and Administrative Costs for more information.

Total Indirect Costs:

This total will be automatically calculated from the "Funds Requested" column.

Budget Justification

The "Budget Justification" attachment is required.

Attach only one file. Attach this information as a PDF. Hyperlinks and URLs are not allowed unless specified in the funding opportunity announcement.

Use the Budget Justification to provide the additional information requested in each budget category identified above and any other information that supports the budget request. The following budget categories must be justified, where applicable: equipment, travel, participant/trainee support, and other direct cost categories.

PHS Additional Indirect Cost - Cumulative Budget

Indirect Costs Totals ($):

All values on this form are automatically calculated and the fields pre-populated. They present the summations of the amounts you entered in the "Indirect Costs" section above, for each of the individual budget periods. Therefore, no data entry is allowed or required to complete this "Cumulative Budget" section.

If any of the amounts displayed on this form appear to be incorrect, you may correct it by adjusting one or more of the values that contribute to that total. To make any such corrections, you will need to revisit the appropriate budget period form(s).