Revised: December 7, 2018

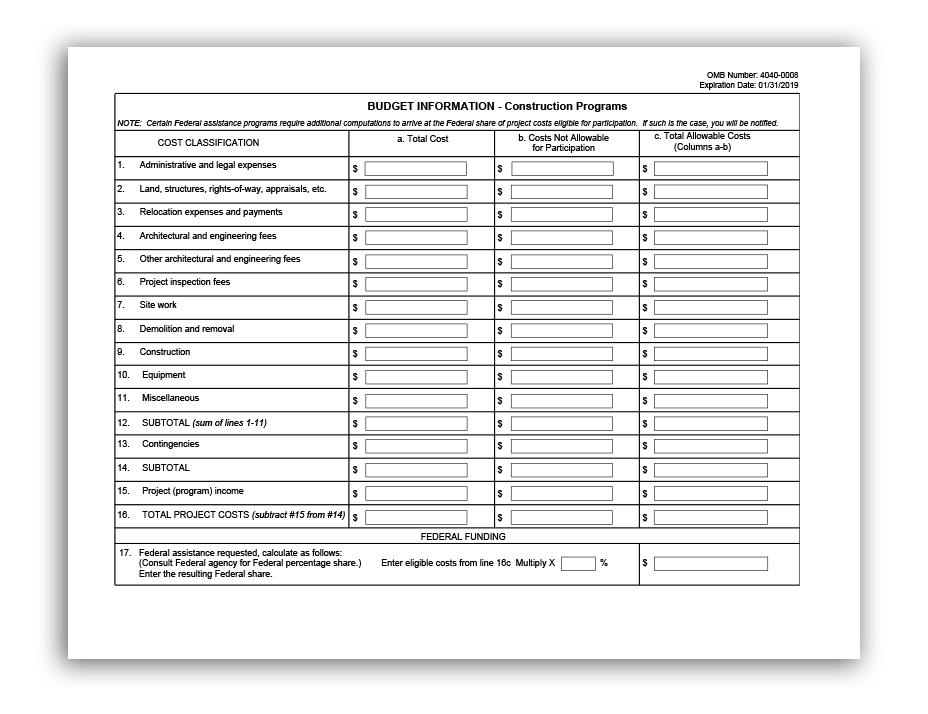

G.360 - SF 424C Budget Information - Construction Programs

The SF 424C Budget Information - Construction Programs form is used only in construction grant applications and repair, renovation, and modernization grant applications (activity codes C06, G20, and UC6). If you are applying to one of these activity codes, the SF 424C Budget Information - Construction Programs form is the only budget form you need to fill out with your application. Refer to your FOA for specific instructions regarding your application. When FOA-specific instructions deviate from those in these instructions, follow the FOA-specific instructions.

Federal Funding

Who should use the SF 424C Budget Information - Construction Programs form?

Use the SF 424C Budget Information - Construction Programs form only if you are submitting an application for a research construction program grant (such as to activity code C06), or a resource program (such as activity code G20), or a construction cooperative agreement grant (such as activity code UC6). The SF 424C Budget Information - Construction Programs form is the only budget form you will need to submit with your application.

For more information:

For more information on construction, modernization, or major alteration and renovation of research facilities, see the NIH Grants Policy Statement, Section 10: Construction, Modernization, or Major Alteration and Renovation of Research Facilities.

Using the SF 424C Budget Information - Construction Programs form:

If no funds are requested for a required field, enter "0" or leave the field blank.

Use the SF 424C Budget Information - Construction Programs form to attach a budget page, if specified in your FOA, for the total requested funds.

Cost Classification

1. Administrative and legal expenses:

1a. Total Cost

Enter the total funds requested for administrative and legal expenses.

1b. Costs Not Allowable for Participation

Enter the costs not allowable for participation in administrative and legal expenses. Refer to your FOA to determine whether there are any special instructions for costs not allowable.

1c. Total Allowable Costs (Columns a-b)

This field will be automatically calculated and will reflect the total allowable costs (the value in column a minus the value in column b) for administrative and legal expenses.

2. Land, structures, rights-of-way, appraisals, etc.:

2a. Total Cost

Enter the total funds requested for land, structures, rights-of-way, appraisals, etc. expenses. Refer to your FOA to determine whether there are any special instructions for costs not allowable.

2b. Costs Not Allowable for Participation

Enter the costs not allowable for participation in land, structures, rights-of-way, appraisals, etc.

2c. Total Allowable Costs (Columns a-b)

This field will be automatically calculated and will reflect the total allowable costs (the value in column a minus the value in column b) for land, structure, rights-of-way, appraisals, etc.

3. Relocation expenses and payments:

3a. Total Cost

Enter the total funds requested for relocation expenses and payments.

3b. Costs Not Allowable for Participation

Enter the costs not allowable for participation for relocation expenses and payments.

3c. Total Allowable Costs (Columns a-b)

This field will be automatically calculated and will reflect the total allowable costs (the value in column a minus the value in column b) for relocation expenses and payments.

4. Architectural and engineering fees:

4a. Total Cost

Enter the total funds requested for architectural and engineering fees.

4b. Costs Not Allowable for Participation

Enter the costs not allowable for participation for architectural and engineering fees.

4c. Total Allowable Costs (Columns a-b)

This field will be automatically calculated and will reflect the total allowable costs (the value in column a minus the value in column b) for architectural and engineering fees.

5. Other architectural and engineering fees:

5a. Total Cost

Enter the total funds requested for other architectural and engineering fees.

5b. Costs Not Allowable for Participation

Enter the costs not allowable for participation for other architectural and engineering fees.

5c. Total Allowable Costs (Columns a-b)

This field will be automatically calculated and will reflect the total allowable costs (the value in column a minus the value in column b) for other architectural and engineering fees.

6. Project inspection fees:

6a. Total Cost

Enter the total funds requested for project inspection fees.

6b. Costs Not Allowable for Participation

Enter the costs not allowable for participation for project inspection fees.

6c. Total Allowable Costs (Columns a-b)

This field will be automatically calculated and will reflect the total allowable costs (the value in column a minus the value in column b) for project inspection fees.

7. Site work:

7a. Total Cost

Enter the total funds requested for site work expenses.

7b. Costs Not Allowable for Participation

Enter the costs not allowable for participation for site work.

7c. Total Allowable Costs (Columns a-b)

This field will be automatically calculated and will reflect the total allowable costs (the value in column a minus the value in column b) for site work.

8. Demolition and removal:

8a. Total Cost

Enter the total funds requested for demolition and removal expenses.

8b. Costs Not Allowable for Participation

Enter the costs not allowable for participation for demolition and removal.

8c. Total Allowable Costs (Columns a-b)

This field will be automatically calculated and will reflect the total allowable costs (the value in column a minus the value in column b) for demolition and removal.

9. Construction:

9a. Total Cost

Enter the total funds requested for construction expenses.

9b. Costs Not Allowable for Participation

Enter the costs not allowable for participation for construction.

9c. Total Allowable Costs (Columns a-b)

This field will be automatically calculated and will reflect the total allowable costs (the value in column a minus the value in column b) for construction.

10. Equipment:

10a. Total Cost

Enter the total funds requested for equipment expenses.

10b. Costs Not Allowable for Participation

Enter the costs not allowable for participation for equipment.

10c. Total Allowable Costs (Columns a-b)

This field will be automatically calculated and will reflect the total allowable costs (the value in column a minus the value in column b) for equipment.

11. Miscellaneous:

11a. Total Cost

Enter the total funds requested for miscellaneous expenses.

11b. Costs Not Allowable for Participation

Enter the costs not allowable for participation for miscellaneous expenses.

11c. Total Allowable Costs (Columns a-b)

This field will be automatically calculated and will reflect the total allowable costs (the value in column a minus the value in column b) for miscellaneous expenses.

12. SUBTOTAL (sum of lines 1-11):

These fields (12a, 12b, and 12c) will be automatically calculated and will reflect the sub of the values in fields 1-11 for each of the columns (a, b, and c).

13. Contingencies:

13a. Total Cost

Enter the total funds requested for contingency expenses.

13b. Costs Not Allowable for Participation

Enter the costs not allowable for participation for contingencies.

13c. Total Allowable Costs (Columns a-b)

This field will be automatically calculated and will reflect the total allowable costs (the value in column a minus the value in column b) for contingencies.

14. SUBTOTAL:

These fields (14a, 14b, and 14c) will be automatically calculated and will reflect the sum of the values in fields 12 and 13 for each of the columns (a, b, and c).

15. Project (program) income:

15a. Total Cost

Enter the total anticipated program income.

15b. Costs Not Allowable for Participation

Enter the program income not allowable for participation.

15c. Total Allowable Costs (Columns a-b)

This field will be automatically calculated and will reflect the total project (program) income (the value in column a minus the value in column b).

16. TOTAL PROJECT COSTS (subtract #15 from #14):

These fields (16a, 16b, and 16c) will be automatically calculated and will reflect the difference of the values in fields 14 and 15 for each of the columns (a, b, and c).

Federal Funding

17. Federal assistance requested

Consult the NIH or other PHS Agency to which you are applying for the applicable federal percentage share. Enter that amount into field 17.

17c. Federal assistance requested, Total Allowable Costs

This field will be automatically calculated and will reflect the total allowable federal assistance requested (the product of the value in field 17 and the value in field 16c).