Revised: December 7, 2018

G.330 - PHS 398 Training Budget Form

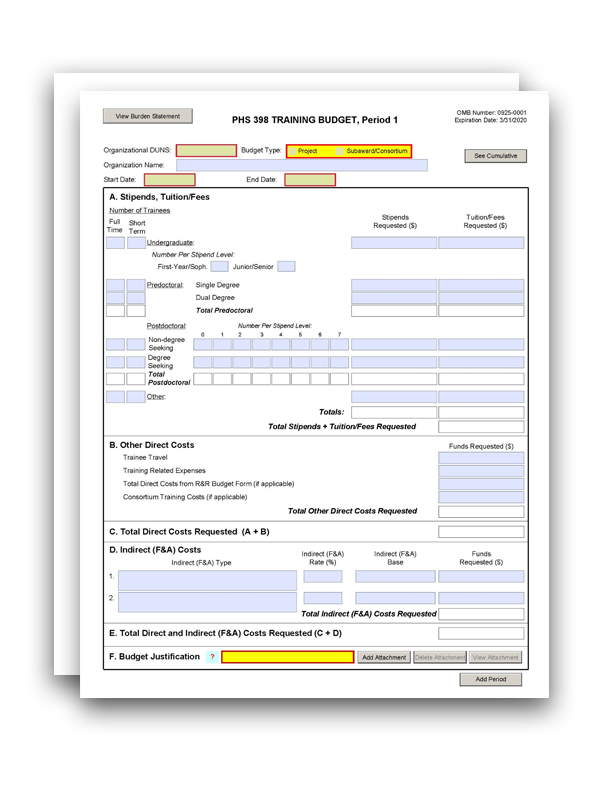

The PHS 398 Training Budget Form is used only for Training applications (e.g., T15, T32, T34, T35, T36, T90) and Multi-project applications with a training component.

The PHS 398 Training Budget Form is not applicable for the K12, T37, D43, D71, or U2R activity codes. Applicants to these activity codes should follow the instructions for the R&R Budget Form and the instructions in the FOA (if applicable).

For current stipend levels and allowable costs, refer to the relevant FOA, NIH's Research Training & Career Development website, or consult the PHS awarding component.

A. Stipends, Tuition/Fees

B. Other Direct Costs

C. Total Direct Costs Requested (A+B)

D. Indirect (F&A) Costs

E. Total Direct and Indirect (F&A) Costs Requested (C+D)

F. Budget Justification

PHS 398 Training Budget, Cumulative Budget

Who should use the PHS 398 Training Budget Form?

Use this form if you will be submitting certain types of Training Applications (e.g., T15, T32, T34, T35, T36, or T90), regardless of the amount of the requested budget.

If you are requesting a budget with $500,000 or more in direct costs for any budget period, contact the awarding component to determine whether you must obtain prior approval before submitting the application. For more information on applications that request $500,000 or more in direct costs, see the NIH Grants Policy Statement, Section 2.3.7.2: Acceptance for Review of Unsolicited Applications Requesting $500,000 or More in Direct Costs.

Certain types of Training Applications, such as K12, T37, D43, D71, and U2R, do not use the PHS 398 Training Budget Form. These applications use the R&R Budget Form.

Note on Subawards/Consortiums: If you have a subaward/consortium, you must use the PHS 398 Training Subaward Budget Attachment(s) Form in conjunction with the PHS 398 Training Budget Form. The prime must extract the PHS 398 Training Subaward Budgets from the PHS 398 Training Subaward Budget Attachment(s) Form and send the extracted file to the subaward/consortium. The consortium should complete the PHS 398 Training Subaward Budget, following the instructions here and in G.340 - PHS 398 Training Subaward Budget Attachment(s) Form.

Using the PHS 398 Training Budget Form:

You must complete a separate training budget for each budget period requested. The form will generate a cumulative budget for the total project period. If no funds are requested for a required field, leave the field blank.

You must round to the nearest whole dollar amount in all dollar fields.

Introductory Fields

Organizational DUNS:

This field is required. This field may be pre-populated from the SF 424 (R&R) Form and should reflect the DUNS or DUNS+4 number of the applicant organization.

Budget Type:

This field is required. Check the appropriate box for your budget type, following these guidelines.

Project: The budget being requested is for the primary applicant organization.

Subaward/Consortium: The budget being requested is for the subaward/consortium organization(s). Note: Separate budgets are required only for subaward/consortium organizations that perform a substantive portion of the project.

If you are preparing an application that includes a subaward/consortium, in addition to completing this form, also see G.340 - PHS 398 Training Subaward Budget Attachment(s) Form.

Organization Name:

This field may be pre-populated from the G.200 - SF 424 (R&R) Form.

Start Date:

This field is required and may be pre-populated from the G.200 - SF 424 (R&R) Form. Enter the requested/proposed start date of the budget period. For period 1, the start date is typically the same as the Proposed Project Start Date on the SF 424 (R&R) Form.

End Date:

This field is required. Enter the requested/proposed end date of the budget period.

A. Stipends, Tuition/Fees

Number of Trainees

Enter the number of trainees for each category (undergraduate, predoctoral, postdoctoral, and other), distinguishing between full-time training positions (i.e., a full year of training) and short term trainees.

Note that some programs do not allow all categories of trainees (e.g., undergraduates are not eligible for T32 applications). Refer to your FOA regarding the eligible types of trainees for your specific application.

- For undergraduate trainees: list separately the number that will be at the First-Year/Sophomore stipend level and the number that will be at the Junior/Senior stipend level in the boxes provided.

- For predoctoral trainees: list separately the number that will be pursuing single degrees and the number that will be pursuing dual degrees in the boxes provided. The "Total Predoctoral" fields will be automatically calculated.

- For postdoctoral trainees: list separately the number that are non-degree seeking and the number that are degree seeking in the boxes provided. If a category (non-degree seeking or degree seeking) contains various stipend levels (e.g., for varying levels of postdoctoral experience or for varying appointment periods), itemize the number of postdoctoral trainees by stipend level in the boxes provided. The "Total Postdoctoral" fields will be automatically calculated.

Stipends Requested ($)

Enter the total stipend amount requested for each trainee type.

For current stipend levels and allowable costs, refer to the FOA or consult the PHS awarding component. For more information, see the NIH's Research Training and Career Development website.

The "Total Stipends Requested" field will be automatically calculated.

Tuition/Fees Requested ($)

Enter the total tuition/fees requested for each trainee type.

See the NIH Grants Policy Statement, Section 11.3.8: Allowable and Unallowable Costs for NIH policy regarding payment of tuition and fees.

Tuition at the postdoctoral level is limited to that required for specified courses that are to be described in Section F. Budget Justification and may depend on whether the program supports postdoctoral individuals in formal degree-granting training.

The "Total Tuition/Fees Requested" field will be automatically calculated.

You should request full needs for tuition and fees. The awarding component will determine the amount of tuition and fees to be provided according to the policies current at the time of award. The formula currently in effect will be applied by the NIH awarding component at the time an award is calculated. Do not include health insurance in the tuition/fees fields.

Total Stipends + Tuition/Fees Requested

This total will be automatically calculated.

B. Other Direct Costs

Enter the total funds requested for Trainee Travel and Training Related Expenses (TRE). If applicable, enter the Total Direct Costs from the R&R Budget Form and Consortium Training Costs.

Trainee Travel

Enter the total funds requested for trainee travel in the "Trainee Travel" field.

Some NIH awarding components provide a pre-determined amount for travel for each full time trainee. Refer to the FOA and/or contact the awarding component to determine the amount provided for travel and enter it here. If the awarding component does not provide a pre-determined amount, enter the requested amount here and provide an explanation in Section F. Budget Justification, stating the purpose of any travel, giving the number of trips involved, the destinations, and the number of trainees for whom funds are requested. PHS policy requires coach class air travel be used. Justify any foreign travel in detail, describing its importance to the training experience.

Training Related Expenses

Enter the total funds requested for TRE. You must base your requested amount on the number of trainees at the predetermined rate.

Funds to defray other costs of training, such as health insurance, staff salaries, consultant costs, equipment, research supplies, staff travel, etc., are requested as a lump sum based on the amounts specified in the FOA and in the NIH Grants Policy Statement, Section 11.3.8.4: Training-Related Expenses for each predoctoral and postdoctoral trainee.

Health insurance may be covered by TRE only to the extent that the same health insurance fees are charged to non-federally-supported students and postdoctoral fellows.

TRE will be awarded as a lump sum. No further itemization or explanation is required in Section F. Budget Justification.

The awarding component will apply the TRE level established for institutional programs for the relevant fiscal year at the time of award.

Total Direct Costs from R&R Budget Form (if applicable)

Certain FOAs allow funds to cover direct costs for items other than those specified above. Use the R&R Budget Form to submit those costs. The Total Direct Costs from the R&R Budget Form (G.300 - R&R Budget Form, Section G. Direct Costs) should be inserted here. This line should not include any indirect costs.

Additional Instructions for Multi-project:

Skip the "Total Direct Costs from R&R Budget Form" field, as Kirschstein-NRSA Training components do not include the R&R Budget Form.

Consortium Training Costs (if applicable)

If training occurs at more than one institution and there is a transfer of funds between organizations, you must complete the G.340 - PHS 398 Training Subaward Budget Attachment(s) Form. Total the direct costs from the Training Subaward Budget Attachment Forms and insert the total here. The applicant institution is responsible and accountable for any arrangements, expenditures, and submission of all required application forms when more than one institution is involved in the research training program.

Total Other Direct Costs Requested

This total will be automatically calculated based on the sum of the funds requested in "B. Other Direct Costs."

C. Total Direct Costs Requested (A+B)

This total will be automatically calculated based on the sum of the funds requested in both "A. Stipends, Tuition/Fees" and "B. Other Direct Costs."

D. Indirect (F&A) Costs

Indirect costs (Facilities & Administrative [F&A] costs) are defined as costs that are incurred by a grantee for common or joint objectives and that, therefore, cannot be identified specifically with a particular project or program. See the NIH Glossary's definition of Indirect Costs.

Equipment and consortium costs are also excluded from the F&A costs on those training grants where TRE are not calculated and awarded on a lump-sum basis, such as the Maximizing Access to Research Careers Program (MARC).

State and local government agencies will receive the full F&A cost rate.

For more information:

You are encouraged to visit the following Defense Finance and Accounting Services (DFAS) Websites or call DFAS staff at 301-496-2444 for guidance: Main DFAS website, DFAS Frequently Asked Questions. The following website has a listing of unallowable and unallocable costs and the related Federal Acquisition Regulation (FAR) citation for each: NIH Office of Management's Unallowable/Unallocable Cost.

Indirect (F&A) Type:

Enter "F&A."

Indirect (F&A) Rate (%):

Enter "8."

Facilities and Administrative (F&A) costs under Institutional Kirschstein-NRSA awards, other than those issued to U.S., state, or local government agencies, will be awarded at 8%.

State and local government agencies should enter their full F&A cost rate.

Indirect (F&A) Base ($):

Enter the sum of the stipends and the Total Other Direct Costs requested, regardless of whether those direct costs were listed on the PHS 398 Training Budget Form or on the R&R Budget Form. Indirect costs are not paid on Tuition/Fees, equipment, or sub-grants and contracts in excess of $25,000.

Funds Requested ($):

Enter the product of Indirect (F&A) Rate and the Indirect (F&A) Base. Refer to the NIH Grants Policy Statement, Section 7.4: Reimbursement of Facilities and Administrative Costs for more information.

E. Total Direct and Indirect (F&A) Costs Requested (C+D)

This total will be automatically calculated based on the sum of the "C. Total Direct Costs Requested" and "D. Total Indirect (F&A) Costs Requested" fields.

F. Budget Justification

A Budget Justification attachment is required.

Attach one file for the entire project period.

Explain in detail the composition of any of the above costs, as necessary, according to the guidelines listed here:

- Itemize tuition and individual fees. If tuition varies, (e.g., in-state, out-of-state, student status) list these separately. Do not include health insurance in the tuition and fees category.

- If tuition is requested for postdoctoral trainees, the specific courses or formal degree-granting program must be described.

- If the awarding component does not provide a pre-determined amount for travel for each full time trainee, explain the requested amount and describe the purpose of any travel, indicating the expected number of trips involved, the likely destinations, and the number of trainees for whom funds are requested, bearing in mind that PHS policy requires coach class air travel be used.

- Any foreign travel must be justified in detail. Describe its importance to the training experience and how those opportunities differ from and complement those offered by the grantee institution. Also describe the relationship of the proposed off-site training experience to the career stage of the grantee.

- Justify the number of training slots (e.g., predoctoral and/or postdoctoral) requested. For postdoctoral training slots, justify the stipend levels requested.

Note for Applicants Using both the PHS 398 Training Budget Form and the R&R Budget Form: Generally, the Budget Justification included in the PHS 398 Training Budget Form should reflect only funds requested on the PHS 398 Training Budget Form. When the R&R Budget Form is also used, two separate Budget Justifications are required, each covering the costs requested in the respective Budget Form.

PHS 398 Training Budget, Cumulative Budget

All values on this form are automatically calculated, and the fields are pre-populated. They present the summations of the amounts you entered previously for each of the individual budget periods. Therefore, no data entry is allowed or required to complete the "Cumulative Budget" section.

If any of the amounts displayed on this form appear to be incorrect, you may correct it by adjusting one or more of the values that contribute to that total. To make any such corrections, you will need to revisit the appropriate budget period form(s).